Purchasing Policy

Updated

Purchasing Thresholds

Purchasing threshold judgements are determined at the "unique transaction" level

Follow this link to access full Financial Policies and Procedures

Threshold | Former Procedure | New Procedure as of Jan. 1, 2020 |

Micro Purchases: $0-$10,000 | Written quotes normally required; Purchase Orders required in most cases | No supporting documentation required; Purchasing through Bigelow requires a PO to document approvals unless a vendor is specifically exempted. If a vendor is exempted, purchasing approvals will be gained through the vendor bill approval process. Purchasing through a corporate card is allowable, but expenses are not allocable to a specific cost center until justified and approved on an expense report. Expense reports must always have approval of the owner of the cost center and available budget to meet the costs. |

Small Purchase Procedures: $10,000.01-$250,000 | Quotes and price justification required; sole source documentation required if multiple quotes cannot be obtained. | Quotes and price justification required or a clear sole source document with a justification based on an emergency or uniqueness. The number of quotes required are as many as reasonable to justify the request (normally at least 3 but, context matters - justify your request!). Purchasing must be done through a PO and all documents attached to the electronic record under the communications>files tab. |

Formal Competition Required: Over $250,000 | Not specifically defined. | Competition, technical evaluation, and price evaluation is required, with clear and robust supporting documentation. See allowable procurement methods in the procedures. |

Note: All Purchase orders and expense reports must be submitted in NetSuite for documentation purposes. The Business office does accept paper POs after Aug 1, 2020.

Purchase Orders:

A purchase order is required for all vendor purchases except when a credit card (personal or corporate) is used as the payment method or if vendors are specifically exempted from Purchase Orders because they are deemed to meet Bigelow's requirements for competitiveness, transparency, and lowest cost purchasing options.

See the following list of vendors that are exempt from purchase orders using the central billing system (note that if a credit card is used with these vendors, the purchaser would still be required to submit an expense report). Specific Vendors Exempted from Purchase Orders for Purchases less than $10,000.

Purchase orders may remain open for up to 12 months - stale purchase orders (older than 12 months) will automatically be closed out by the Business Office.

A list of vendor account numbers can be found HERE.

When to use an Expense Report in NetSuite:

Expense reports are used specifically for requesting Credit Card Reimbursements or other personal reimbursements:

Category | Description |

Non-Travel Reimbursement on a personal or corporate credit card, or cash purchase | Purchases on corporate card or personal credit cards or cash purchases may be reimbursed based on a fully approved expense report with sufficient documentation of charges. As a 501c3, taxes are not normally charged to Bigelow and will not be reimbursed for purchases made on your personal credit card outside of a Bigelow Purchasing system (see tax section under procurement for more detail). Taxes on reimbursement for approved travel expenses are reimbursable on either a personal or corporate card up to the per diem limit. Approval is defined as when the expense report is approved as allocable to eligible Bigelow projects, not when the charge happens. The card holder may be liable for credit card purchases until such time as when the expense report is approved. |

Reimbursement for Travel Expenses (receipts and per diem notes): GSA rate travel tools https://www.gsa.gov/travel-resources

Category | Description |

Lodging | Receipts required and government rates should be requested when working on a Federal award. Lodging will be reimbursed at the actual rate up to the GSA lodging rate limit for the location. For lodging costs in excess of per diem limits, an exception to policy can be requested when exigent circumstances prevail by attaching a written memo or a note to the electronic file (attach either on the expense line item or in the Communications>Files tab). Exigent circumstances may be "government rates not available" due to limited vacancy or evidence that multiple quotes were requested at multiple hotels in the area that travel was required and the lowest reasonable option was selected. |

Mileage | Can be reimbursed on an expense report based on the prevailing IRS rate for mileage reimbursement based on usual road distances. You may attach a google maps trip distance calculation to note the road distance. Note the start and end location and the distance in the description of the reimbursement line. No other documentation is required. The current IRS standard mileage rate is 70 cents per mile (effective January 1, 2025). |

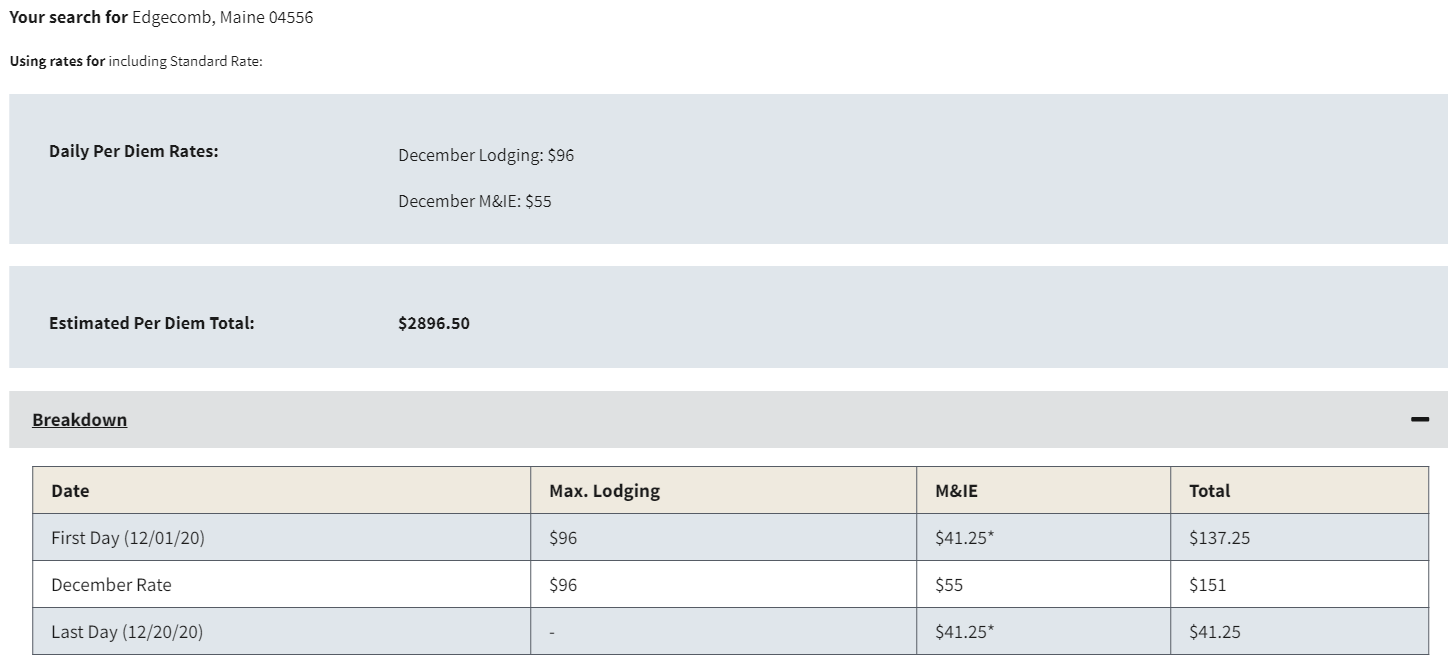

Meals | Two methods are authorized - either the actual reimbursement method or the per diem limit. For the actual reimbursement method, receipts are required, reimbursement may be requested up to the per diem limit, and corporate card can be used. For reimbursement based on the GSA per diem limits, justification can be requested based on the rates as defined by the GSA travel tables for your travel location up to the full per diem amount. Attach the GSA per diem (printed or a screen shot) back-up for your request to the expense report. For this method, you should use the following website: https://www.gsa.gov/travel-resources and screenshot the following travel per diem authorization. The M&IE column will be used to calculate the meal per diem authorized reimbursement for the trip. Note the first and last day of travel is calculated at a reduced rate.  |

Commercial Travel (Flights and ground transportation) | Commercial travel options will follow the actual method of reimbursement and taxes may often be unavoidable when doing standard booking outside of a governmental travel system. Travelers are encouraged to seek tax exemptions where possible. Reimbursement will be based on actual costs incurred. You should always seek the lowest cost options when looking at transportation options. Offering to show Bigelow's Permanent Exemption Certificate for tax exemption purposes may help if you are on business travel. Rental Car Insurance: You do not need rental insurance as it is covered by your corporate card's master rental insurance coverage so long as you abide by the rental agreement when you are renting a car within the 48 contiguous States. The Collision damage waiver insurance is reimbursable for rentals taking place outside the 48 contiguous states and for all truck rentals regardless of your location. You must use your corporate card for this coverage to be in place. Under normal travel circumstances, you should decline all other offered insurance coverage. Coverage will not be reimbursed if you accept coverage or decide to use your personal credit card to rent a vehicle unless extreme circumstances prevail. |