Expense Report (example)

Updated

Expense Reports are used to reimburse employees for expenses incurred personally or to their corporate cards. See the policy article for more detail.

This page is meant to serve as a model for expense reports. How to guides for filling them out can be found on the SRS Expense Report article.

There are two basic ways to complete an expense report (ER):

- One expense report for each charge

- One expense report for multiple expenses (or the entire credit card statement when using the corporate card)

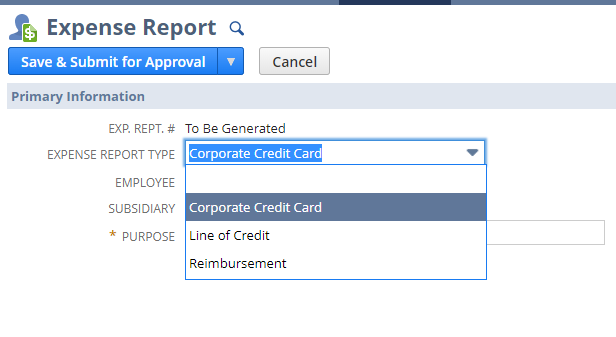

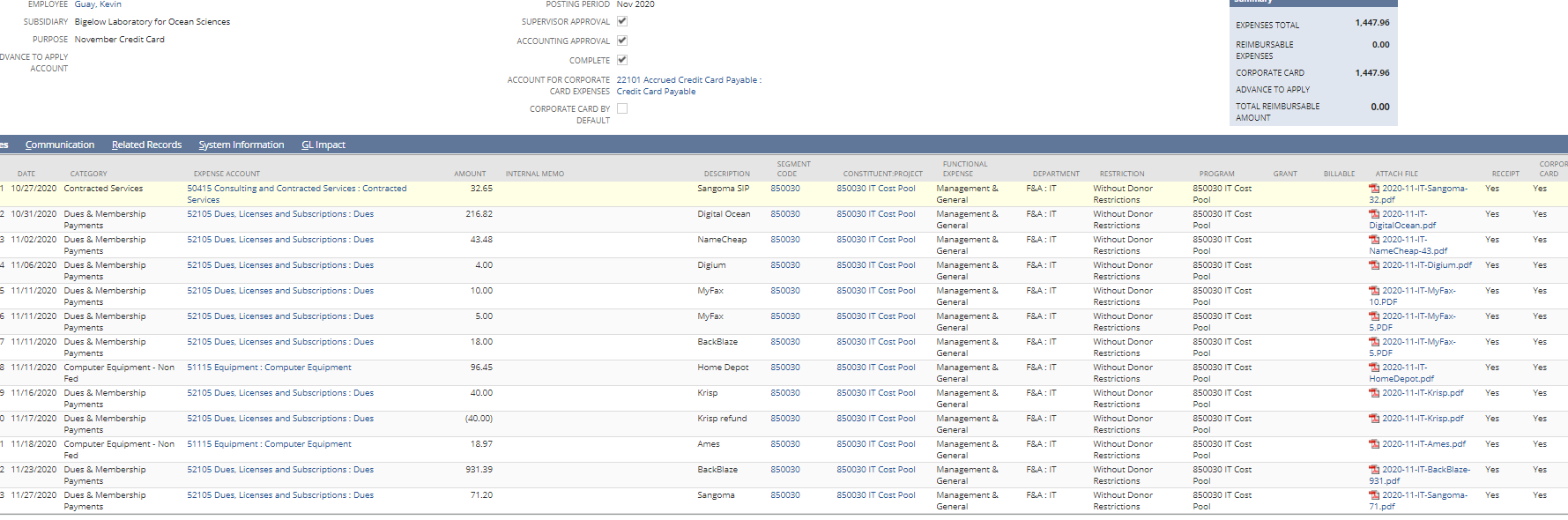

Example #1: Expense Report (ER) for November 2020 corporate credit card charges for an individual at the lab with a corporate card. First step is to choose the correct ER 'type':

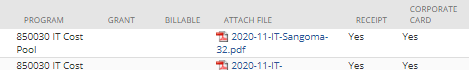

Note expense categories are then fully defined per charge and individual receipts are attached on each line.

Highlight of an individual line with the receipt back-up and the summary:

Most Frequent errors:

** Use the actual transaction date on the expense report transaction line (not the date you are entering the ER!)

** If you are requesting per diem for meals, don't use your corporate card

** Save your receipts when looking for actual reimbursement and attach them to your expense report

Note also that the sum of the corporate charges tie to the capital one account balance for the individual user. It is recommended that you create a user name and password on the Capital One Corporate Cards site to ensure your monthly charges tie to your monthly expense reports.

Group Meals: For "group meals" on or off travel status the policy is to seek reimbursement based on actual if you are paying for employees at a lunch event, board member, or other. The expense report should list what the event is for and the attendees for record keeping purposes. The key is that we are not double dipping by requesting per diem on one report for a trip and asking for actual reimbursement separately for the same event/meal on the same day.

__________________________________________________________________________

Travel

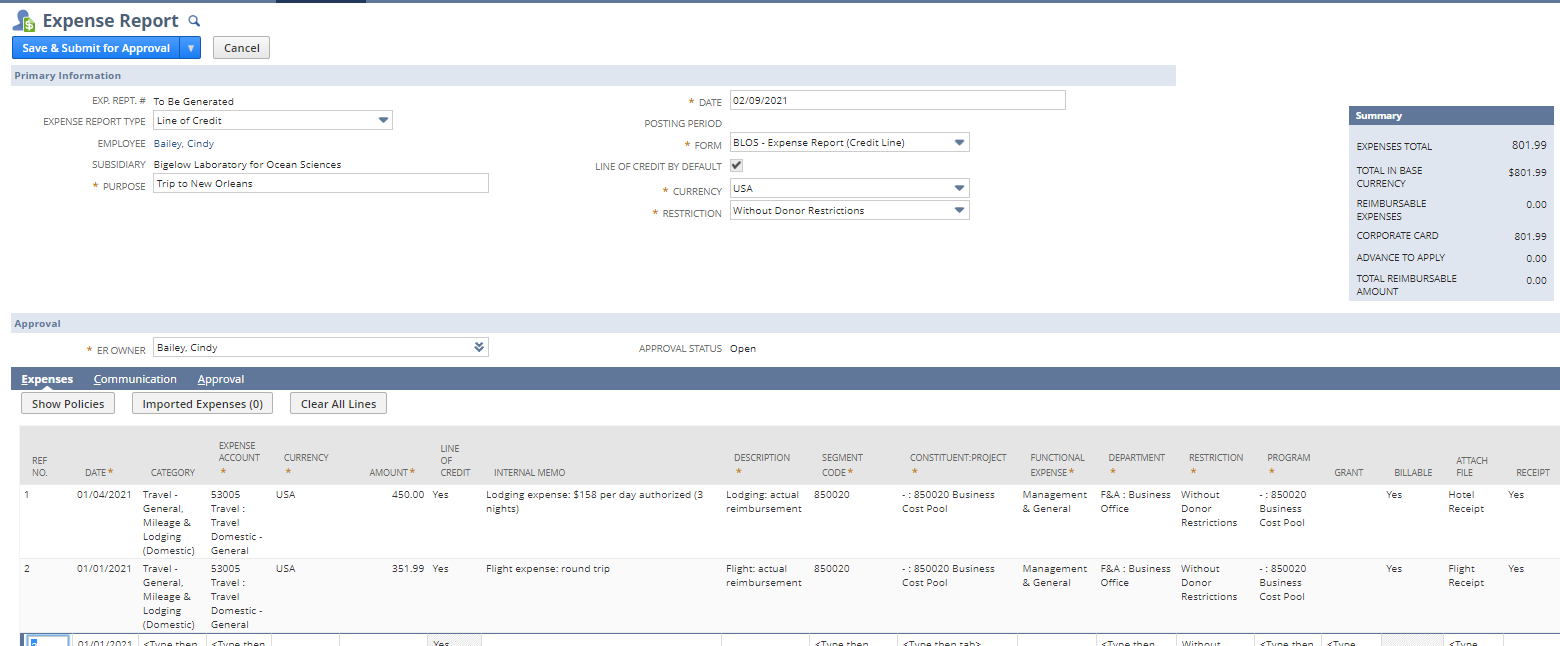

Example #2: Travel Expense Report:

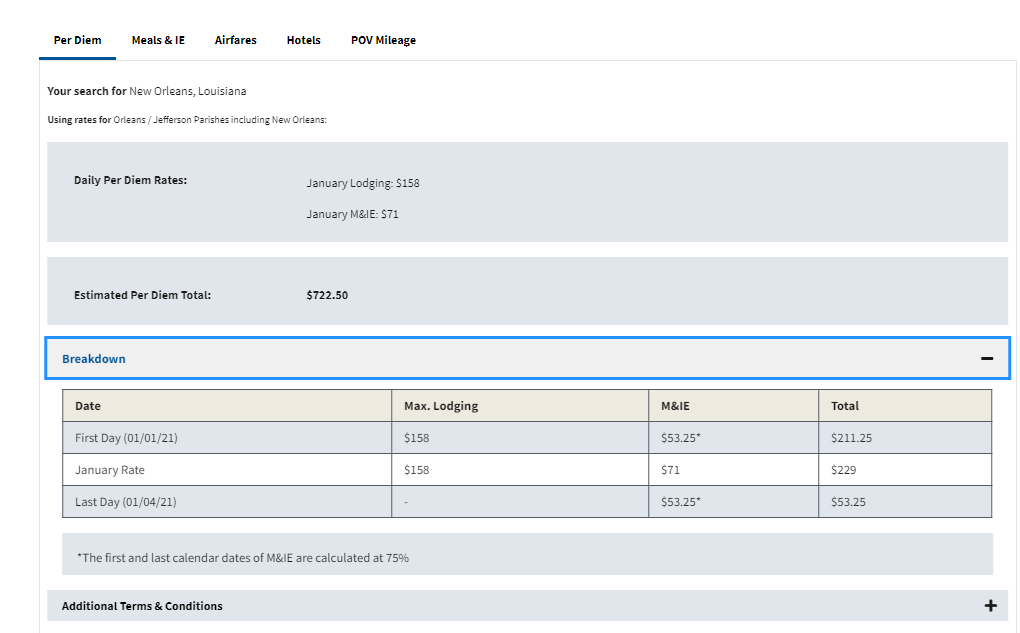

Meal reimbursement: Bigelow allows reimbursement to travelers for meals and incidental expenses (M&IE) based on the per diem method as shown on the per diem tab on the GSA travel website (first website tab - screenshot is shown below). The GSA website should be utilized to look up eligible per diem amounts. You should print the authorized amounts or take a screenshot and use this as back-up when justifying the amounts you are requesting for reimbursement on your expense report. This will facilitate the approval process. Note that grant budgets are often limited and PIs/SRSs may impose additional restrictions. You should seek guidance from your PI/SRS prior prior to travel on more specific reimbursement authorizations.

To use M&IE per diem, you must use personal financing means to purchase (i.e. not your corporate card). If using the actual reimbursement method, your average meal charges must still be below the average per diem as measured across the duration of your trip or you may be personally liable for the difference. If you go over the per diem authorized amount and decide to use your corporate card, you may write a check for the difference made payable to "Bigelow Laboratory for Ocean Sciences" or allocate the charges to your strategic reserve if you have sufficient funding.

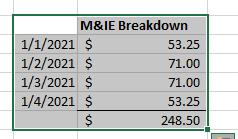

Per diem meal (M&IE) authorization example: For my trip to New Orleans, from 1/1/2021 and 1/4/2021 you are using the M&IE per diem. You will review the authorized per diem limits on the GSA travel site. Use the site to calculate per diem authorizations. You will see the following: open the breakdown section to see the meals and incidental expense (M&IE) breakdowns (this is your per diem, meal authorization). Everything you need is on the first tab. This determines the Bigelow authorized per diem amount.

Using this information, you may request up to $248.50 for your per diem meals reimbursement for a trip duration between 1/1 - 1/4/2021. Note that the first and last days of travel have a lower M&IE authorization. See below.

If you choose to spend more on meals than your authorized per diem amounts, you can still only be reimbursed up to the per diem limit.

Lodging, airfare, parking fees, and commercial transportation use: The lodging per diem should guide you selection of appropriate lodging. Unless exigent circumstances prevail, you should seek lodging at or below the per diem limit. Lodging, commercial transportation (airfare/taxis), and rental cars will use the actual reimbursement method and use of your corporate card is preferred. Please remember to select the "corporate card" check box on the individual expense report line. Receipts are required. Travelers should make every effort to obtain government rates for lodging while they are on travel status and working on a federal grant. Seek specific guidance from your PI/SRS when determining whether you need a rental car. Using lodging in excess of the per diem limit may be taxable to the employee per the IRS.

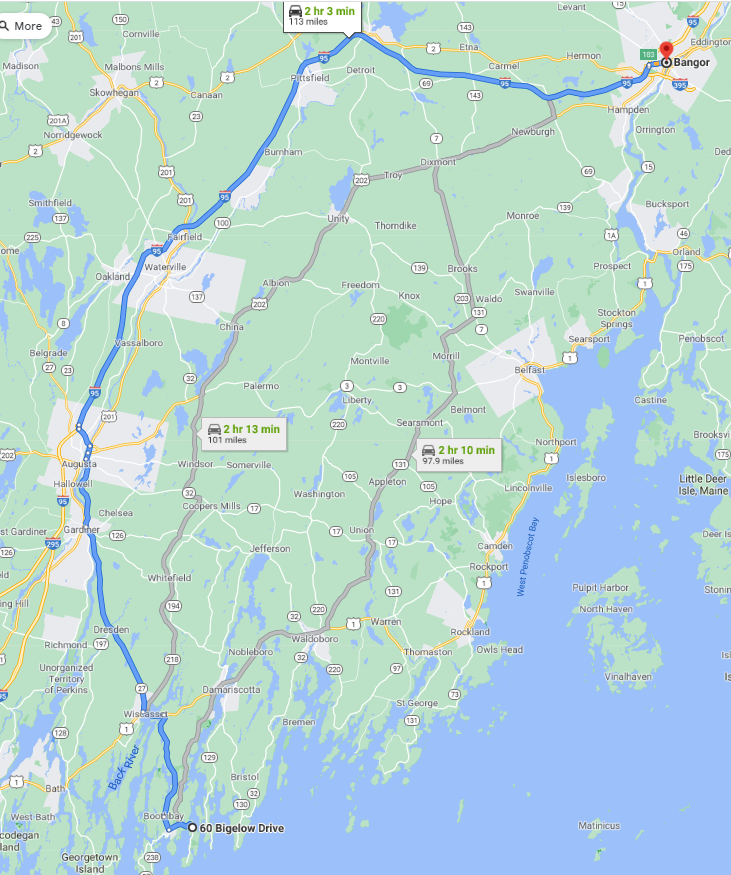

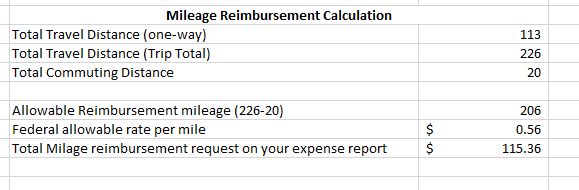

- Mileage will be calculated using the shortest road distance or fastest route available from the point of origin for travel and the destination as measured by google maps.

- For example, travelling from Bigelow to Bangor produces a fastest route at 113 miles v. the shortest route of 97.9 miles. Travelers may chose to use either.

- Travelers will use the current IRS 'Business Use' mileage rate to request reimbursement. Click HERE for the current mileage rate.

- A trip to Bangor from the lab in 2023 would be calculated at .655 cents per mile x 113 miles x 2 in order to account for 2 way travel.

- Travelers should attach supporting evidence to the travel line when requesting mileage reimbursement.

- If a traveler is normally commuting to the lab and is travelling in lieu of commuting on a particular day, the mileage reimbursement should be reduced by the total commuting distance normally travelled.

- For example, if a round trip commute is normally 20 miles and a traveler is going to Bangor in lieu of commuting to the lab, the traveler should reduce their total travel reimbursement request by 20 miles. See the example below beneath the google maps image extract.

Other fees: Registration, gas, tolls, other. These are other fees that may be incurred while on travel status. Use of your corporate credit card is preferred for expense reimbursement. Travelers should save their receipts and attach them as back-up when requesting reimbursement.

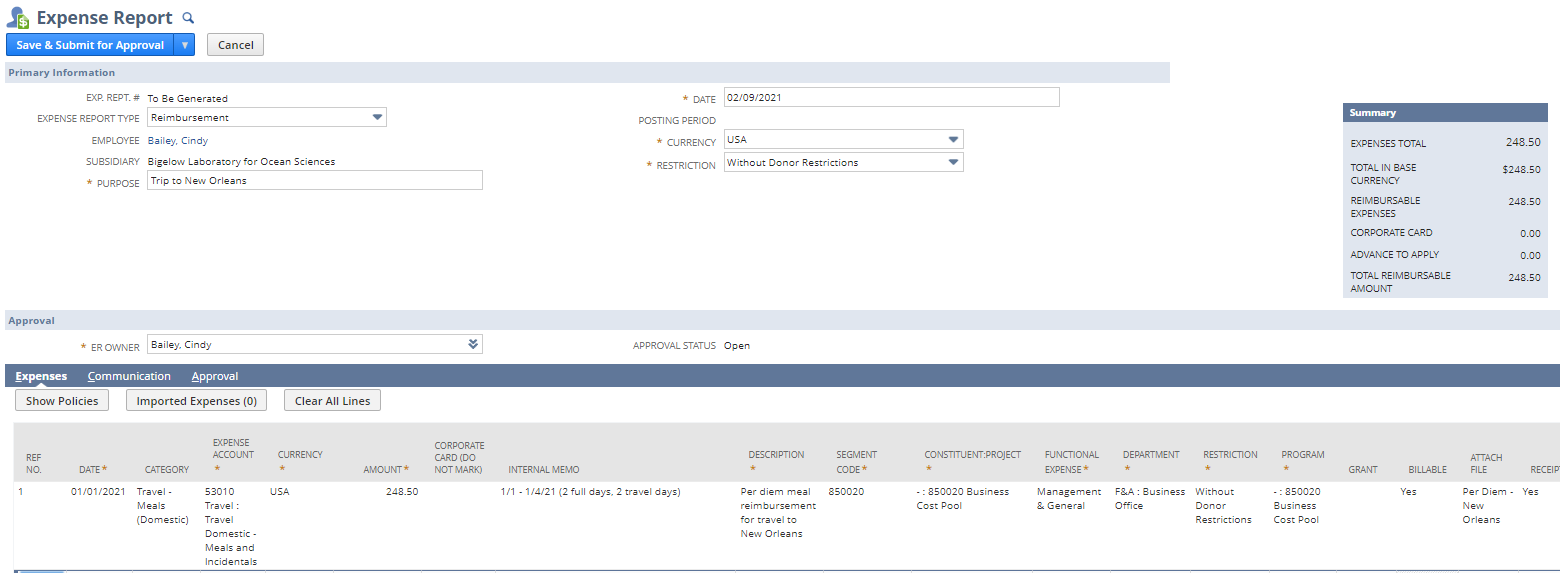

Expense Report Example: For my trip to New Orleans, I am submitting the following expense report. I am requesting a M&IE reimbursement of $248.50 for the trip (note I have no meals or incidental expenses on my corporate card). I am also requesting reimbursement for lodging and airfare - since those were charged to Melon's LOC or my corporate credit, a separate ER is required. Note that if meals were provided at the conference, I would adjust my per diem authorization by the appropriate amount referencing the GSA Travel table. If I had requested any mileage reimbursements for my trip to the airport, I would have uploaded a google maps printout with the appropriate distances.

Note - be explicit in the internal memo line regarding meals to indicate travel dates and/or how many at regular and how many at 75% of per diem, supplemented by the screen shot of the GSA allowable.

If you do not have access to supporting documentation (or receipts have been misplaced), please use this Missing Receipt form.