Workshop, Training Projects, and Participant Support Help

Updated

Purpose: the following is being provided as a practical guide on how to understand and manage events/workshops for participants and employees.

Content:

I. Definitions

II. Managing events onsite at Bigelow

III. Managing events offsite (employees on travel status)

IV. Examples

V. Project Set-up Recommendations

I. Definitions:

Catered meals - is a term that is unallowable under participant support categories of expenses. Bigelow defines catered meal as food that is both delivered and served by serving staff. The act of delivering food to the lab can be allowable under participant support if it is not also served. These meal expenses can be paid direct or on a reimbursement basis to the participants so long as sufficient documentation (which means, include an attendance list) exists to allocate the expenses.

If you are dealing with participant support expense codes, avoid the word "catering." It isn't allowable.

Catering can be an allowable cost (code "catering" or "food delivered for an event" to Conferences and Training - GL 55010). Allocating expenses here will incur indirect.

Participants: The National Science Foundation (NSF) defines a participant as a non-employee who receives a service or training opportunity as part of a sponsored award-funded activity. Participants are not paid salaries, but may be provided with stipends, subsistence allowances, travel allowances, or registration fees. Participants are the recipients of these opportunities, not the providers. Speakers at events are not participants.

II. Events/Workshops that take place at Bigelow

- If you are planning events for Advancement or staff event projects, generally, the unallowable cost code will be used for any expenses dealing with food or alcohol. If you are doing catering, use the 55010 expense code, conferences and training.

- If you are planning events for research or grant funded education events this guide is for you. Things to keep in mind.

- Employees are not participants.

- Employees are typically charging the award for their time while at the event. They are not eligible for additional stipends.

- Employee meals cannot be funded from participant support codes. Unless it is specifically authorized in an award, employee meals also cannot be funded by grant award funds with non-participant support codes. Federal cost principals are driving at not paying someone on an award as an employee and funding their meals at the same time, except if they are on travel status (e.g. if an employee is working at your normal place of business, you wouldn't charge your meals to the award, right? Attending an event is not an exception to this prohibition).

- If you are involving employees and paying for their meals, unless the award specifically allows this, you will need to seek alternate funding (non-grant funds) or have employees pay for their own meals. A good technique is to track the employee expenses and the separate funding source in stand-alone project. This means do not contract for catering for employee meals and charge it to your award unless it is specifically allowable on your particular award.

- Participant meals can be funded through participant support - subsistence meals. Participant support does not incur indirect. An attendee list is required to properly allocate expenses to participant support. If you don't have a guest list, code all expenses to the training and conferences, 55010 expense code and take the indirect.

- Participant lodging expenses can be paid from participant support - residence expense codes. For on-campus events, we typically bill these expenses directly using internal billing codes. A reservation or some form of back-up is required to justify the charges.

- Participants may receive a reasonable stipend for their time at an events if budgeted and authorized on an award. Try and avoid justifying a stipend as "meal reimbursement" especially if you are providing meals at the event.

- Speakers at events can be paid a reasonable fee. Use the professional services expense code if that is authorized by the award. This will incur indirect. Forms of honorarium are otherwise unallowable under any participant support codes. It is possible for speakers to be both professionals delivering training and also participants at different times in the same event so long as those acts are documented and allocated accordingly. For example, if Scientist A is a speaker on Day 1 in the morning and receives a fee, they are not eligible for their morning meal to be paid from participant support - you could charge 55010, conferences and training in this example. If they meet the definition of a "participant" by lunch and you document this with an updated attendee list, those expenses could be allocated to participant support. The burden of documentation is on the event program manager to properly charge participant support. It really isn't that complicated - this boils down to have to maintain an attendance list (event attendees do not need to sign!) allocated between employees, participants, and speakers to properly allocate expenses.

III. Guidance for projects offsite

The only real difference if you are planning events offsite is that employees are eligible to be on travel status (over 60 miles from Bigelow campus) and expenses for employees that are travelling can be coded to Bigelow travel accounting codes. These expenses will incur indirect.

IV. Examples

Example 1: I want to provide $100 worth of food from EBGS and/or the grocery store to 15 participants in an NSF-funded training activity on Bigelow campus, which will also have 5 employees in attendance. How do I bill those expenses?

- 75% of the expense (i.e. 15/20 people) should be charged to GL code 50315 Participant Support - Subsistence, with documentation provided on who is a participant and who an employee and what the training activity was, along with the receipt. This is not subject to IDC.

- 25% of the expense (i.e. 5/20 people) should not be charged to the project (because employee meals cannot be charged to a federal grant when the employee is on campus) OR it should be charged as GL code 59060 Unallowable Expenses on a non-federal project (like your strategic reserve or discretionary funds or educational projects).

Example 2: I want to provide $100 worth of food from a delivery service to 15 participants in an NSF-funded training activity in Portsmouth, NH, which will also have 5 employees in attendance. How do I bill those expenses?

- 75% of the expense (i.e. 15/20 people) should be charged to GL code 50315 Participant Support - Subsistence, with documentation provided on who is a participant and who an employee and what the training activity was, along with the receipt. This is not subject to IDC.

- 25% of the expense (i.e. 5/20 people) should be charged to GL 55010 Conferences & Training expenses (because employee meals can be charged to a grant when the employee is >60 miles from campus). This is subject to IDC.

Example 3: I want to provide $500 worth of food from a conference food service to >50 participants in an NSF-funded training activity at a big scientific conference in New Orleans, LA. There will not be an attendance list for this open training event, and it will involve employees. How do I bill those expenses?

- 100% of the expense should be charged to GL 55010 Conferences & Training expenses (because there is no attendance list to indicate who is a “participant"). This is subject to IDC.

- Employees on travel status should exclude their reimbursement requests for times when meals are provided and include documentation on those requests.

V. General Project set-up for event Guide:

- I. Useful forms and artifact links:

Bigelow Financial Policies and Procedures - See Section III on participant support rules

- Workshop/Event Purchasing FAQ:

1. Non-employee attendees – these are participants, code all expenses to applicable participant support lines (GL account series 50300) in the “event” (Project 1).

2. Non-employee instructors – These are considered speakers. Speakers are not participants and are not eligible for participant support. Code meal and travel expenses to GL account 53010 and 53005, respectively. Code speakers (avoid the term honoraria) to GL account 55010. All instructor activity should be charged to Subproject 2.

3. Employee attendees – Employees are receiving salary for attending and are not eligible for participant support. They are also not on travel status and ineligible to charge to ‘Travel – Meals’ when charging to a research or education project. Therefore, employee costs should be coded to Subproject 3 (a development project) using GL account 53010. This designation as development is more flexible when we get out of the “research and education” umbrella. Suggestions to fund this project include billing the “President’s Discretionary Fund” (need permission from D. Bronk) or Development. D. Whitt can assist with this when all expenses have settled.

4. Employee instructors – For meal purposes, they are the same as employee attendees. Charge meal expenses to GL account 53010 and Subproject 3. They are eligible to charge direct salary to the event (Project 1), if budgeted.

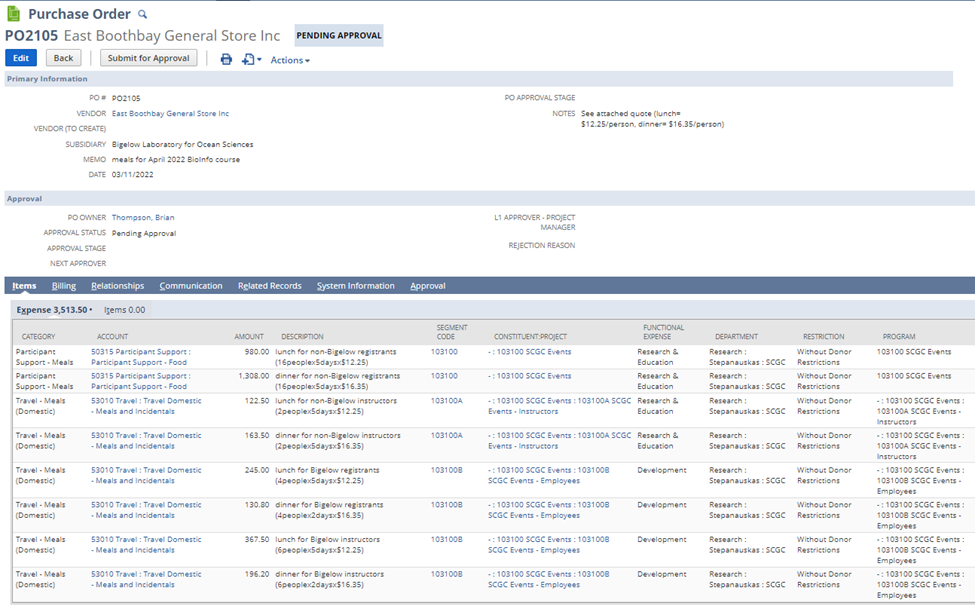

Sample PO for Meals

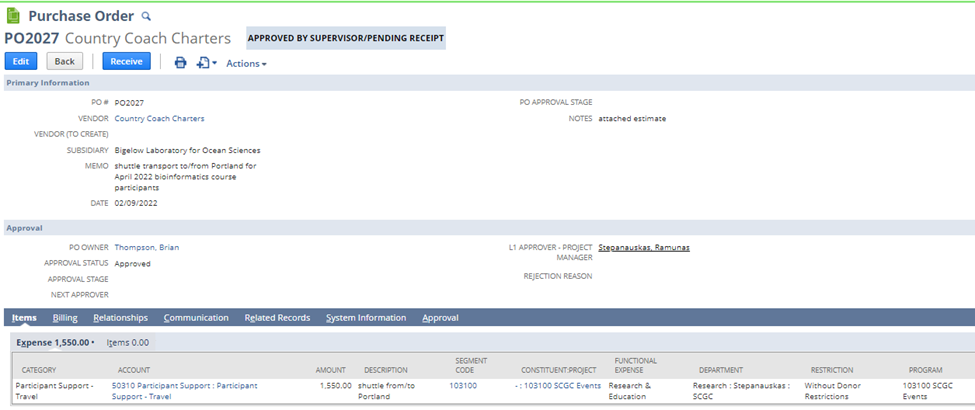

Sample PO for Participant Travel

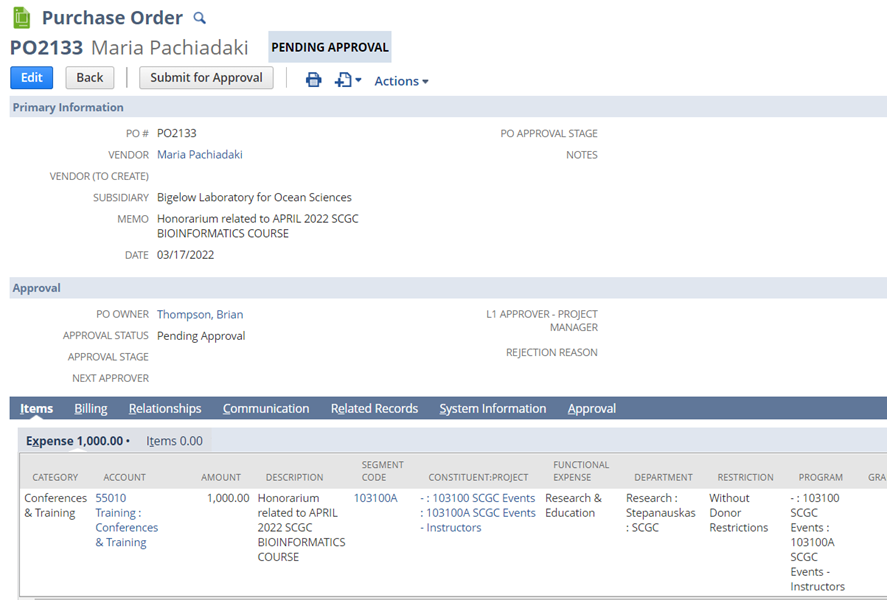

Sample PO for Instructor Speakers (Avoid term honorarium)

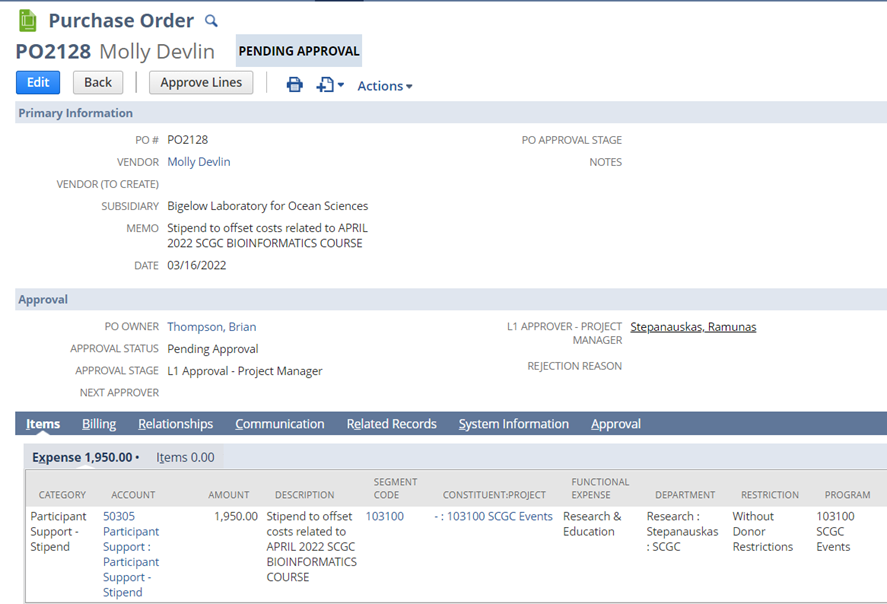

Sample PO for Participant Stipend

- The below is a guide for setting up projects to host event and navigate participant support rules.

- Set-up or use an Event Project (for “participant support” revenue and expenses) – this is the main cost center for the event to code expenses that are eligible to be funded from the registration fees, which are considered program income. The registration fees can be funded from participant support from another grant(s) or by collecting fees directly from attendees. The functional expense of this project should be “research and education.” Code expenses eligible for participant support on this project.

- Sub-projects – Create subproject(s) for instructors’ expenses and employee expenses to this event. At the end of the event, these expenses should be billed (via internal billing process) to another eligible project (non-participant support), development project, or a discretionary fund project.

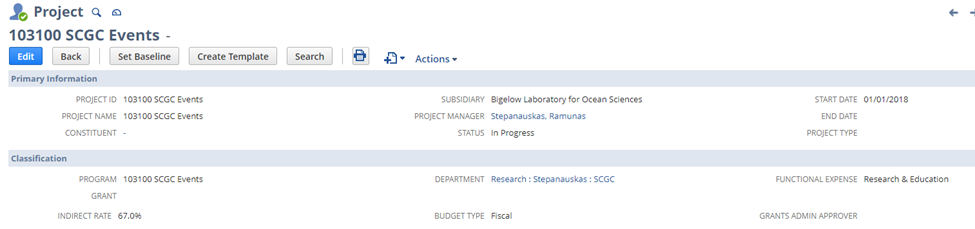

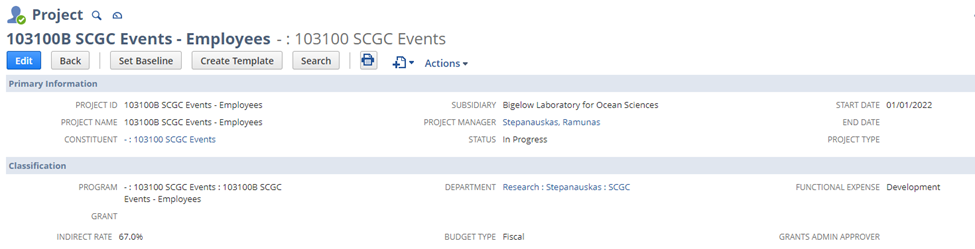

Example project set-ups below:

Example Project Set-up: Registration fees are funded by participant support and other funding/sponsorship (Note: Subproject 2 will not be created in all cases.)

Project 1: Funded by participant support (cost center for all participant support eligible expenses and revenue). Only record participant support revenue and expenses in this project. Functional expense designation is “research and education.”

Subproject 2: Other sponsorship income (if it exists) that is not received from participants or employees can be coded here. This is the place to record non-employee instructors’ expenses (meals, travel, speaker fees, etc). Functional expense designation is “research and education.” Normal indirect applies.

Subproject 3: Cost center for employee activity including any registration fee income or meal expenses. Functional Expense designation is “development.” Normal indirect applies.